State Payroll Tax Compliance Background

Arjun Aggarwal - Founder @ Mandrel

States with remote employees: 4

Tell us about Mandrel

We're building tools to assist consumer brands at the intersection of operations and finance.

Mandrel helps these brands unify the data around financial flows and costs associated with inventory movement across their entire supply chain, from procurement through manufacturing, quality control, freight, and outbound shipment.

Our goal is to automate the workflows, reporting, and analytics around all of this so they can scale more efficiently and reduce costs.

Arjun Aggarwal, Founder @ Mandrel

Arjun Aggarwal, Founder @ MandrelDescribe why you love your role

I used to work in a physical goods business where I encountered many of the challenges we’re hoping to address.

I ran product there for six years, and as the macro condition changed, I spent a lot of time starting to focus a lot more on profitability and margins and getting full visibility into cost.

Understanding the dollars and cents associated with the supply chain and inventory was a challenge, both historical looking and for forward looking purposes, even though we had a pretty robust IT system set up.

When I was thinking about what to do next, I knew I wanted to help these types of customers and spent a lot of time trying to think about how to do so, and decided the best way was to focus on the challenges that I had in my experiences.

So we founded Mandrel to aid physical goods businesses, and consumer brands specifically, in scaling more efficiently, at a time when it’s harder to raise money, harder to grow, and people are ultimately trying to do more with less.

What words would you use to describe managing state payroll tax compliance manually?

Anxious is probably the best word, mainly because it's something you have to do.

You don't want to do it incorrectly because there's dollars and legal compliance issues at stake.

The last thing that you think about when you’re build a business is “oh, I forgot to process this documentation” or “this submission didn't happen correctly” and now I'm getting hit with thousands of dollars in fees.

It's just not where you want to use your time and money.

So, you want to do it right, but it's also confusing.

That's probably the other word because there's just a lot of different sites you have to do for every single state.

And it's just a pain because you don't know the correct information to use where.

What’s been the impact of using AbstractOps to eliminate those feelings?

I mean, it's just something I don't have to think about as much.

This all started because I made my first hire in New York, and the guide for getting set up in New York is just totally confusing.

I didn’t understand half the forms. They all look like they go to the same website and there's no one I can call because they don't pick up the phone.

So I was like “let me see what’s out there to make this easier.”

I just wanted to find a solution that helped me make sure that I have everything, that I hit the right agencies and withhold the right amounts, and make sure I'm paying into the right amounts.

When it first came up, it felt like something I really had to stay on top of given the timeline for our New York registration, which is not where I wanted to be focused.

Now, I just don't have to think about it and worry about “Did I do this the right way? Is this going to go through properly? How am I going to be able to file all my stuff on time? Am I inputting the right information from those registrations into other places?”

So it just feels like a huge relief.

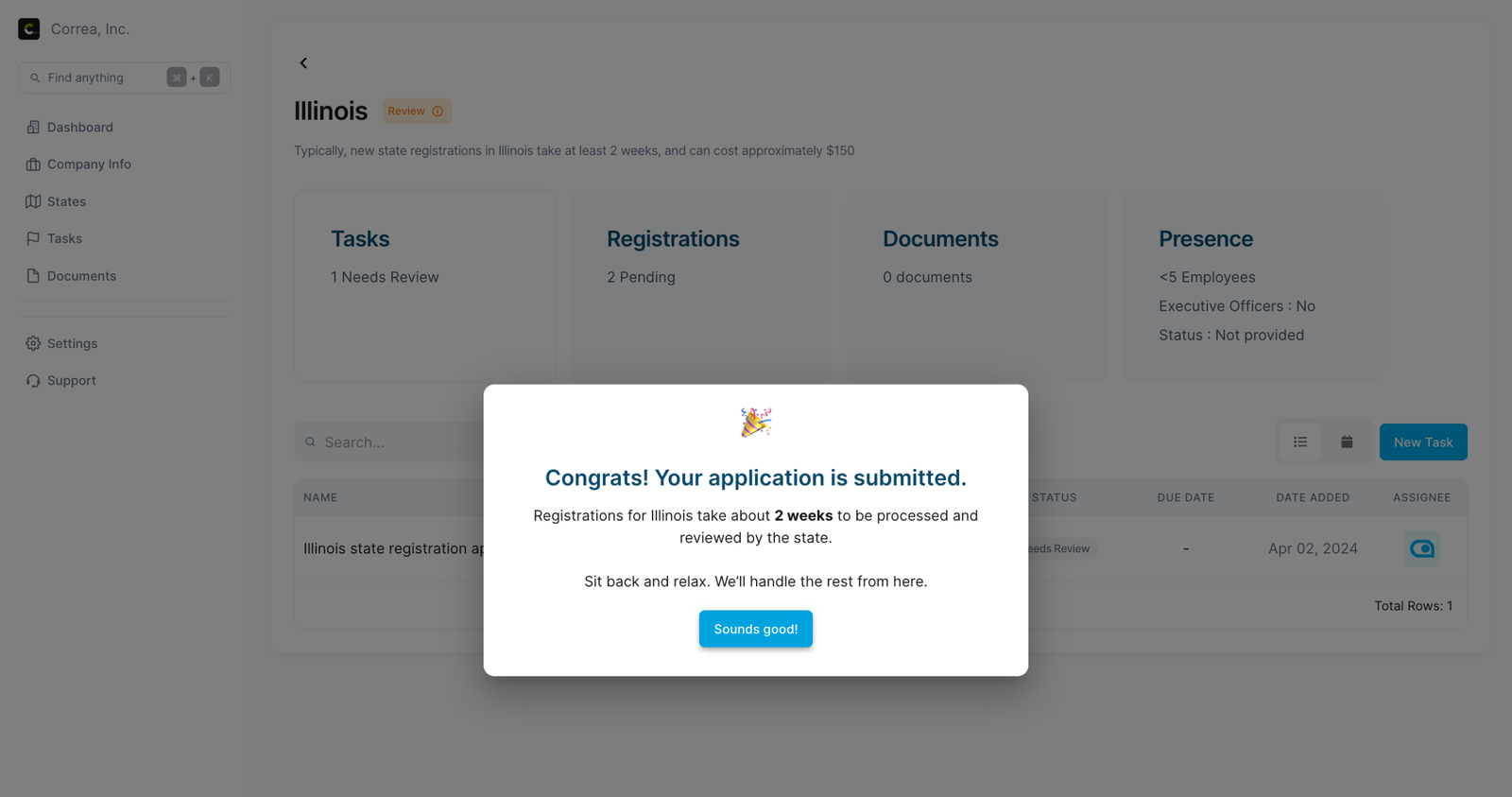

Arjun used AbstractOps to automate the New York state registration process

Arjun used AbstractOps to automate the New York state registration processAdditional notes from the AbstractOps team

Arjun’s not the only brilliant founder that’s felt totally confused by payroll tax and entity compliance.

50 states where you need to register.

50 different sets of rules and regulations you need to learn.

Close to 100 different websites you need to navigate.

In addition to running the company.

Arjun uses AbstractOps to automate state registrations and annual filings, entering some basic information and eliminating the anxiety he previously faced.

If you’re feeling a bit anxious yourself, start the AbstractOps product demo here.