Summary

If you're considering hiring remote employees in New York, use this guide to:

- Explore the criteria triggering the need for a New York Secretary of State Business Registration, including physical presence, economic activity, and advertising efforts.

- Determine where and how to register with the New York Secretary of State.

- Understand additional requirements such as Registered Agents, registration with other state departments, and ongoing annual reports.

New York Secretary of State Business Registration Required?

A variety of activities fall under the category of "doing business" in New York and therefore necessitate a New York Secretary of State Business Registration. These include selling goods or services within the state, maintaining a physical presence such as an office or store, or having employees working in New York. Additionally, engaging in significant advertising or marketing efforts targeted at New York residents may also be classified as conducting business in the state.

Let's take a deeper look.

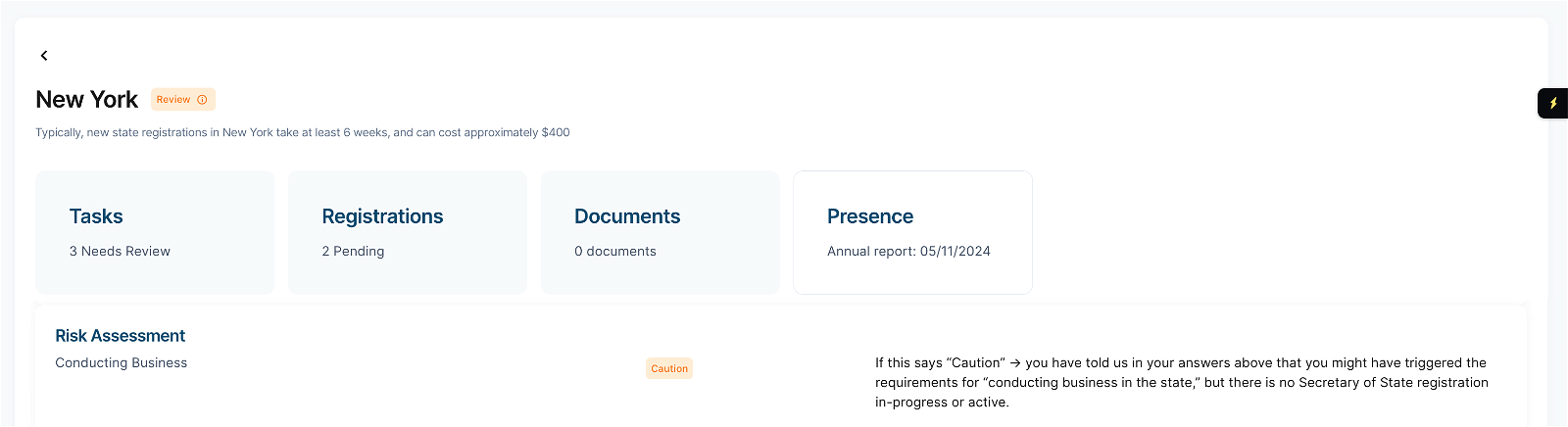

Screenshot of AbstractOps alerting a user that they have triggered a Secretary of State registration requirement.

Screenshot of AbstractOps alerting a user that they have triggered a Secretary of State registration requirement.

A physical presence is typically the most common reason companies will trigger a New York Secretary of State (SOS) registration requirement. Examples of physical presence include:

- Having an office, store, warehouse, factory, or other physical location in the state.

- Having employees or representatives working in New York.

- Owning or leasing property in New York.

New York considers various economic activities as constituting "doing business", including:

- Selling goods or services to customers in New York, even remotely or online.

- Providing services within New York State.

- Regularly soliciting business or engaging in transactions within the state

- Licensing or deriving income from property located in New York.

The following activities are likely considered doing business in New York:

Operating a physical retail store in New York.

Maintaining a warehouse or distribution center in New York to fulfill orders.

Providing consulting, repair, or other professional services to clients in New York.

Regularly selling products through an online store or marketplace to New York residents.

Having a New York-based franchise of your business.

Nexus: New York follows the concept of nexus, which means even without a physical presence, a sufficient level of economic activity in the state can trigger tax and registration obligations. Remote sellers need to pay special attention to sales thresholds.

Foreign Corporations: If your business is incorporated outside New York, you'll likely need to qualify to do business in the state by obtaining a "Certificate of Authority".

Where to Complete Your New York Secretary of State Business Registration

- An Application for Authority must be completed via paper filing.

How Long Does This Registration Take

- New York typically takes more than 4 weeks to review and process SOS registrations.

How Difficult is This State's Registration

- New York's Secretary of State registration is on the more difficult end of the registration spectrum.

- In addition to the various requirements to consider, the fact that New York requires a paper registration means that founders should allocate considerable time if they plan to process the registration themselves.

New York Secretary of State Business Registration Fees

- $250, made payable to the New York Department of State, should be forwarded to the New York Department of State, Division of Corporations, One Commerce Plaza, 99 Washington Avenue, Albany, NY 12231

Additional Requirements at Registration

Additional SOS Registration Requirements

- A COGS (Certificate of Good Standing) dated within 1 year.

- A Registered Agent is required to serve as the company's physical in-state presence to receive important legal documents. Do not fall victim to the common misconception that you can leverage an in-state employee as your Registered Agent. It's far too risky.

Additional Department Registration Requirements

In addition to registering with the Secretary of State, New York requires companies register with the state Revenue (DOR) + Department of Labor (DOL).

- These registrations can be submitted via the NY.gov portal, and typically take several weeks to process.

Ongoing Requirements

Additional SOS Ongoing Requirements

- A New York Secretary of State Annual Report must be submitted each year.

- The dates vary depending on when registration was completed.

- If you prefer to DIY annual reports, search for your company name here to determine deadline and submit.

- Alternatively, people at companies with 10 - 300 employees typically use AbstractOps' Starter plan to eliminate the mental burden of remembering and executing SOS annual reports.

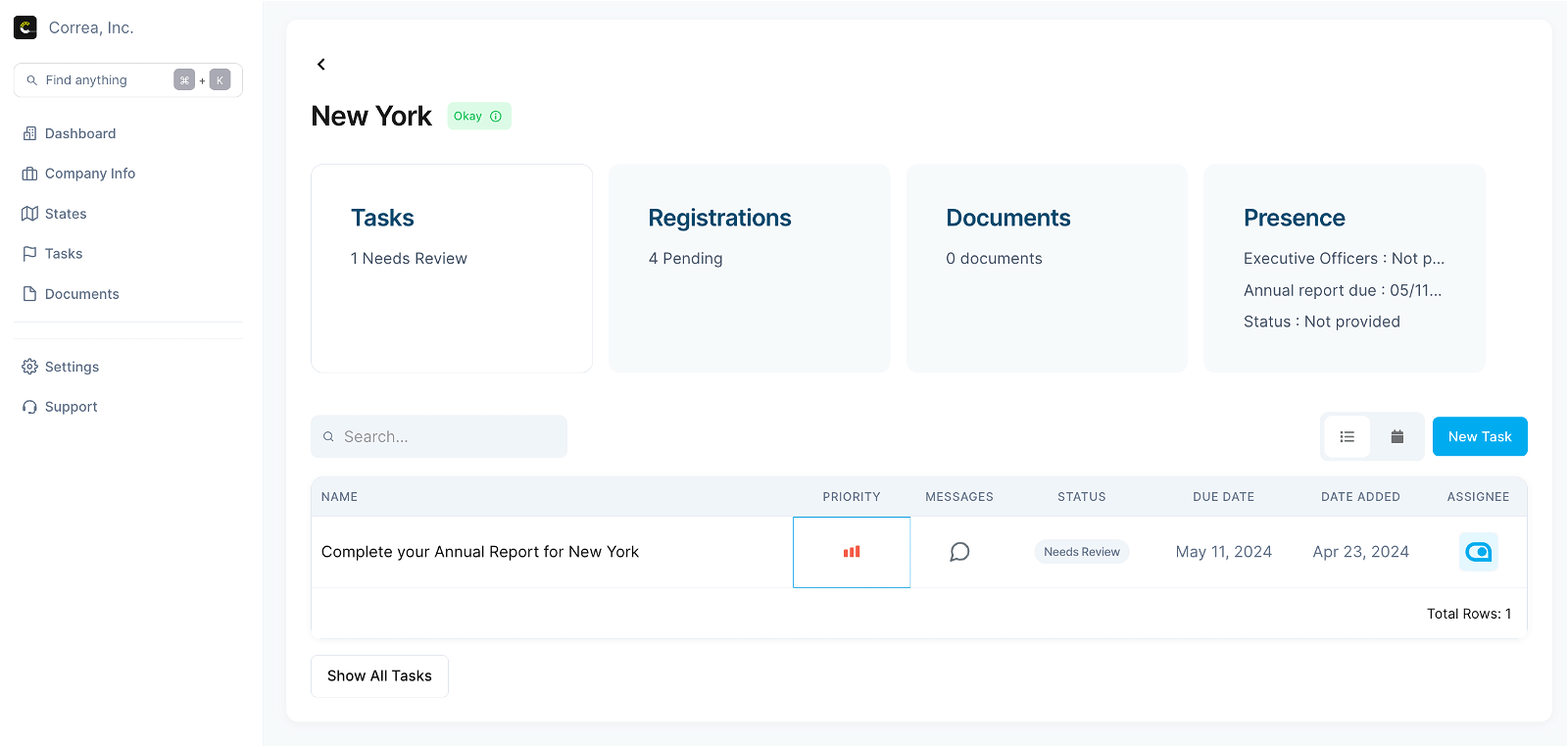

A screenshot of New York state managed within the AbstractOps app.

A screenshot of New York state managed within the AbstractOps app.

Additional Department Ongoing Requirements

- New York requires an annual withholding return and wage report. These are typically filed by your company's payroll provider.