TLDR:

- Not all state compliance notices require payment; a little research can potentially save thousands of dollars.

- Don't wait until a remote employee's first day to register your company in their state.

- If you keep a state account open even after an employee departs, you must continue maintaining state compliance. Consider closing dormant accounts to mitigate risk and penalties.

- Relying on in-state employees as registered agents poses risks; dedicated services offer reliability in handling legal documents.

- In addition to payroll tax, secretary of state registration is often a sneaky but critical state compliance requirement.

You'll receive a bunch of notices from the state each year. Most are important for maintaining state compliance - a filing reminder here, a notice of late payment there.

What people don't realize, however, is that many other notices could state errors, and some are outright scams.

Before quickly paying them, do some research. You may find that you didn't actually file late, but rather your payroll filed on time but maybe it hit the state's system at a delayed time.

It can be a pain - on the order of several hours researching, calling, and sitting on hold with a state. But if it saves you, $500, $600, $700 each time? It may be worth it.

TO DO:

It’ll take several hours of research + phone time, but calling the states to hash it out can save serious $.

Sequential prioritization can be unintentionally dangerous approach when it comes to state compliance.

Oftentimes when hiring a new person, it's easy to overlook the question "will this person be our first employee in X state?"

If they are - most states take several weeks to process registrations. If your registration is not processed, your payroll may be blocked.

TO DO:

If you're hiring in a new state, start the registration process as soon as the employee signs their offer letter.

Not true at all. The state doesn't care if you're paying someone there or not. As long as you have an active account, you're liable for quarterly and annual filings.

When you have someone leaving the company and it means that there's no longer going to be employees in that state, you need to ask the questions 1) "are we going to hire again in this state?" and 2) "If yes, will it be within the next six to eight months?"

If the answer to either is no, then those accounts should be closed to reduce your risk in that state.

Why? Because often when there's no one there, it's a state that you don't really think about. And if you're not thinking about it, you're going to start getting fines and penalties for not filing on time.

$50, $100 fines might not seem like a lot, but the longer you wait, the more it piles up and the more stressful it gets.

TO DO:

Audit your state count and future hiring plan, and close accounts prior to the end of the fiscal year if you don’t anticipate hiring there.

As we described in an earlier post, by law, many states require some physical in-state address to receive important legal documents.

It's easy to assume an in-state employee can be used here; after all, they have a physical foothold in the state and can receive documents, right?

Technically sure, but, if your company ever does receive a service of process, which likely has a deadline to respond to legal documents - do you want to risk it being lost or mishandled by an employee?

For peace of mind, you likely want to utilize a service that specializes in making sure that those documents get to the right point of contact within your business.

TO DO:

Simply Google Registered Agent services and compare prices.

A standalone registered agent can cost $150 - $300 / year, but reduces risk and headaches.

A standalone registered agent can cost $150 - $300 / year, but reduces risk and headaches.

Once you've hired someone in a new state, 99.9% of the time you will need to create the standard payroll tax accounts, such as a withholding account and an unemployment account.

However, folks often fail to realize they may also need a secretary state or a foreign qualification registration; the reason - not every state has the same requirement here.

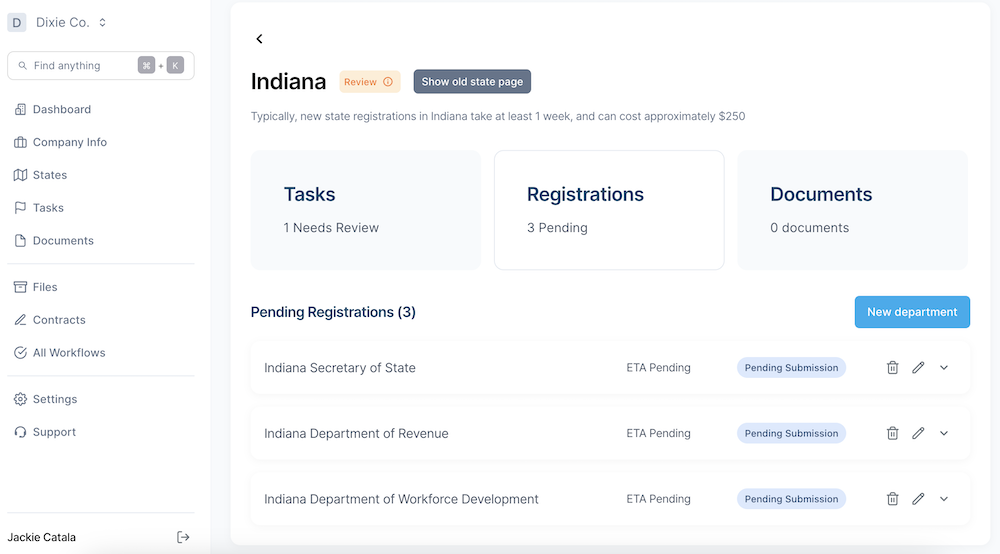

A screenshot of the AbstractOps UI, proactively alerting the user of this state's Secretary of State requirement.

A screenshot of the AbstractOps UI, proactively alerting the user of this state's Secretary of State requirement.

In about 30 states, as soon as you hire a remote employee, you trigger the requirement to register with the Secretary of State. This is true regardless of whether you're using a PEO or standard payroll provider.

Fail to comply, and watch the fines start piling up, and get worse the longer you wait to register.

I've seen people fail to do so and owe upwards of $2,500 in a state that only cost $750 to register, simply because they weren't aware of the requirement in that specific state.

TO DO:

Confirm if you currently have employees in states that require SoS registration, and whether or not your payroll provider will handle filing it.

_____

About the author: Kristin Bass has helped over 100 companies navigate the confusing world of state compliance. Prior to her role as the CEO of AbstractOps, she worked as an Operations Analyst at FIS Global. She holds an MBA from East Carolina University and has a deep love for animals, especially her two labrador retrievers.